north dakota sales tax online

Thursday June 23 2022 - 0900 am Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up. This allows you to file and pay both your federal and North Dakota income tax return.

.png)

States Sales Taxes On Software Tax Foundation

To search for a specific guideline use the search boxes to enter the.

. Municipalities may impose a general municipal sales tax rate of up to 2. Sales and use tax rates look up. Exact tax amount may vary for different items.

The total tax rate might be as high as 85 percent depending on local municipalities. North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. 2022 North Dakota state sales tax.

North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. For the fastest processing time please have the following information ready to complete the online application for a North Dakota Sales Tax Number. Municipal governments in North Dakota are also allowed to collect a local-option sales.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges. North Dakota Sales Tax and Other Tax Guidelines Home Guidelines Guidelines Guidelines are listed below by tax type. Additionally the state reduces the tax rate for business taxpayers purchasing new farm.

The South Dakota Department of Revenue administers these taxes. North Dakota participates in the Internal Revenue Services FederalState Modernized E-File program. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner.

The state general sales tax rate of north dakota is 5. Busineses with nexus in North Dakota are required to register with the North Dakota Department of Revenue and to charge collect and remit the appropriate tax. This free and secure.

Register for a South Dakota sales tax license using the online Tax License Application. North Dakota Tax Nexus. The current state sales tax rate in North Dakota ND is 5.

North Dakota ND Sales Tax Rates by City The state sales tax rate in North Dakota is 5000. Business name physical mailing. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more.

Apply online at the North Dakota Taxpayer Access Point TAP. Registered users will be able to file and remit. North Dakota has a statewide sales tax rate of 5 which has been in place since 1935.

Sales tax rates in north dakota. North Dakota individual income. The sales tax rate for North Dakota is 5 percent plus the applicable rate for local jurisdictions.

Seminar and a two-hour NDSD Border Construction Contractors Seminar are held twice a year once in. The state sales tax rate in north dakota is 5000. Or file by mail using the North Dakota Application for Income Tax Withholding and Sales and Use Tax Permit.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is. They may also impose a 1 municipal gross. To find a specific form use the search boxes to enter the name of the form select the tax type choose the tax year or include the.

Forms are listed below by tax type in the current tax year. With local taxes the total sales tax rate is between 5000 and 8500.

North Dakota Office Of State Tax Commissioner Bismarck Nd Facebook

How To Get A Certificate Of Resale In North Dakota Startingyourbusiness Com

North Dakota State Abbreviation And North Dakota Postal Abbreviation

Welcome To The North Dakota Office Of State Tax Commissioner

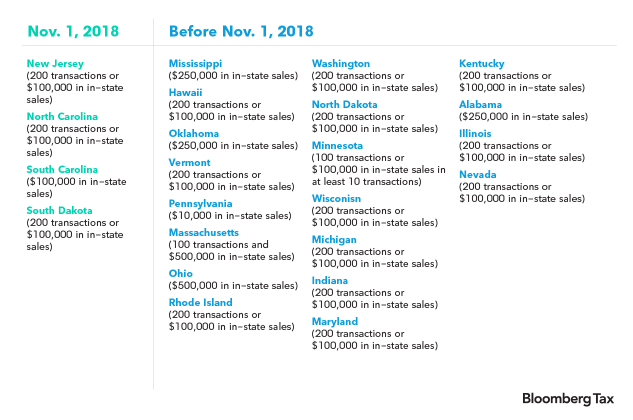

Four More States Begin Online Sales Tax Enforcement Nov 1

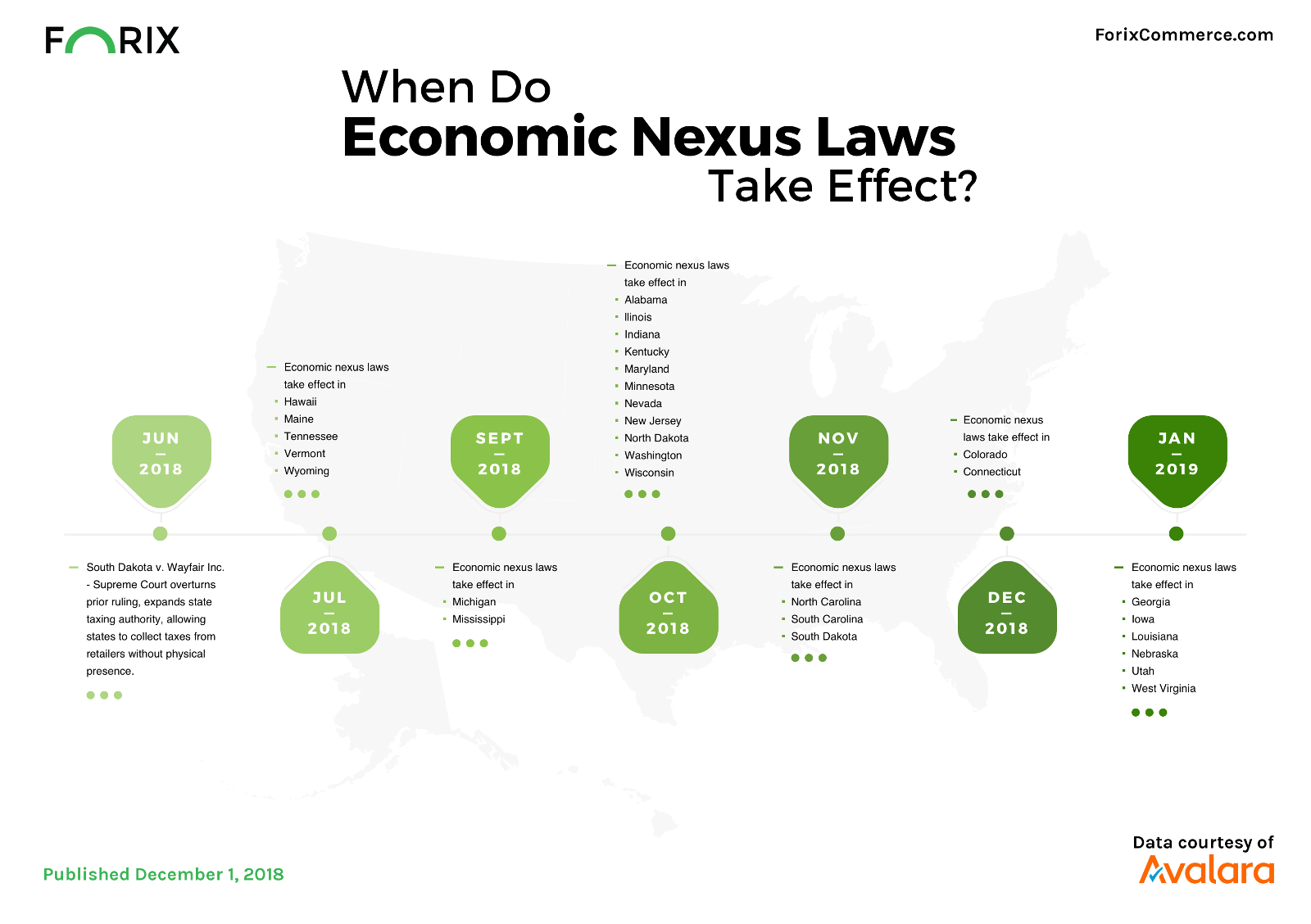

Economic Nexus And South Dakota V Wayfair Inc Avalara

Welcome To The North Dakota Office Of State Tax Commissioner

How To Collect Sales Tax For Magento Websites

Supreme Court Widens Reach Of Sales Tax For Online Retailers The New York Times

Tax Compliance For Startups And Small Business Nd Women S Business Center

Sales Taxes In The United States Wikipedia

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Welcome To The North Dakota Office Of State Tax Commissioner

More Than 2 100 Online Retailers Have Registered To Collect Nd Sales Taxes Prairie Public Broadcasting